Books On Demand Morocco was established in 2019 with a modest collection of fiction books stored in a pickup truck and kept in a storage unit. Initially, we exclusively promoted and sold our books through Instagram. Our very first successful sales were of the renowned series "A Song of Ice and Fire" by the acclaimed American novelist and screenwriter, George R. R. Martin.

As time went on, we expanded our operations by establishing regional processing centers across the country and employing a dedicated team of professionals. Throughout this journey, we have meticulously developed our processes for book production, grading, and distribution, ensuring the highest standards for Books On Demand.

Today, we proudly stand as Morocco's leading independent online bookseller, specializing in on-demand books. Our operations are characterized by state-of-the-art automation and advanced analytics, all within a safety-centric environment. Our primary digital platform is Booksondemand.ma, which serves as the ultimate destination for book enthusiasts. Furthermore, we continue to engage with our loyal customers on Instagram, where book lovers unite. Each and every book in our inventory undergoes meticulous grading by hand, and we offer a diverse range of formats and conditions to cater to the unique preferences of our customers. Our commitment lies in providing a wide assortment of accurately graded, high-quality books at affordable prices, enriching the reading experience of our esteemed customers.

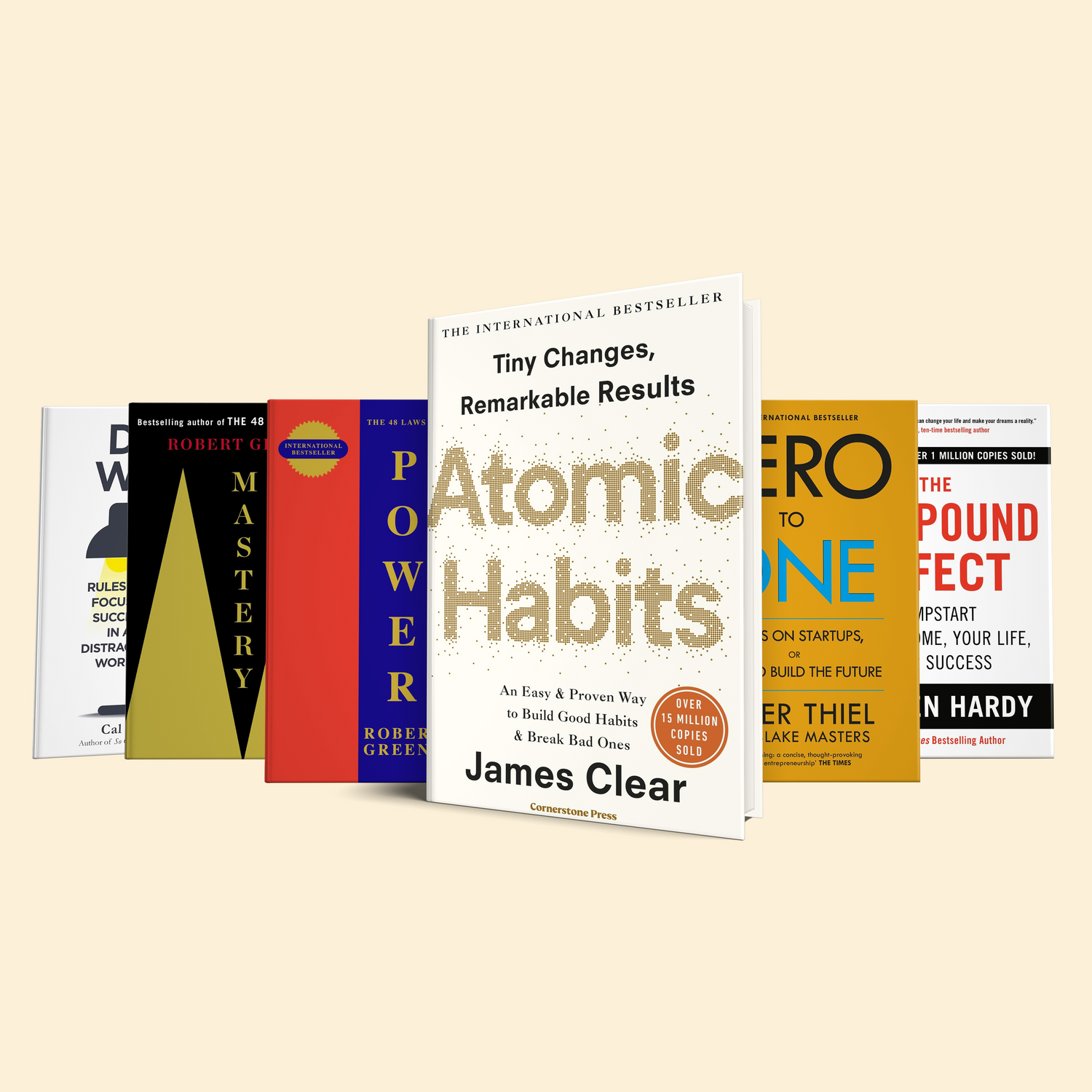

Our partnerships extend far and wide, reaching various communities across the country. At Books On Demand.ma, we firmly believe that progress can be achieved by collectively working towards a shared vision, as it fosters creativity and drives transformative change. We are grateful to all those who have embraced our incredible selection of books, which have the potential to positively impact their lives. Through our platform, we have facilitated access to a wide array of informative books on diverse topics such as business, marketing, leadership, self-help, classics, and novels. Our purpose is to bring readers and their favorite books together, supporting them in their quest to accomplish remarkable feats. We deeply value the unwavering support we have received since day one.

F.A.Q

What is On-Demand

Our service, Books on Demand, is dedicated to meeting your specific book requirements promptly. If you are unable to locate a particular book in our online store, we encourage you to contact us through Instagram at Booksondemand.ma. Our team will go above and beyond to secure the book you're looking for, process your order, and have it delivered to your doorstep.

However, if the book you desire is already available in our store, we kindly request that you place your order directly through our website. This helps us streamline our operations and alleviate the workload for our agents. Currently, we are facing a significant surge in demand and serving a large number of clients, as we continuously test and enhance our service.

"Our products and services are designed to be on-demand, meaning that any book you have in mind can be requested. Simply provide us with a list, and we will make every effort to acquire those books and ship them to your specified location, no matter where you are."

Where is my order?

After placing your order, kindly anticipate a processing time of four to seven business days for printing, packing, and shipment from our warehouses. Once your order is shipped, you will promptly receive a notification via Whatsapp containing detailed information about the delivery date.

Please allow up to 8 business days for the package to arrive to you from the day your order is shipped

How long does shipping take?

Each purchase made within the the Kingdom of Morocco generally entails a processing time of 6-8 business days. It is crucial to bear in mind that our book selling system operates on a On-Demand basis, customizing each order as per the demand, and this process may necessitate up to 5 business days for production before shipment. As a result, the estimated delivery time, starting from the date of purchase, typically averages around 1 week.

What is your return policy?

Kindly be informed that in order to facilitate a smooth refund or exchange process, it is essential for our team to approve all returns beforehand. To initiate a return, we kindly request that you provide us with pictures of the product along with an explanation for the return. Our dedicated team will thoroughly assess the information provided and determine whether the return can be accepted.

Should your return be approved, we will promptly furnish you with comprehensive instructions on how to proceed with shipping the product back to our facility. Please be aware that the shipping costs for returning the item will be your responsibility, and you have the flexibility to choose the shipping service that suits you best.

Our primary goal is to ensure that every interaction you have with us is a positive one, and we remain committed to streamlining the return process for your convenience. If you have any inquiries or concerns pertaining to your return, please do not hesitate to contact us via email at contact@booksondemand.ma or reach out to us on Instagram @booksondemand.ma.

What is your refund policy?

We want to make the refund process easy to understand and transparent, so you know what to expect every step of the way.

Once we receive and check your return, we will let you know the result and confirm if your refund can be approved. If it is approved, we will automatically process it within 10 business days.

However, if more than 15 business days have passed since we approved your return and you still haven't received anything, please don't hesitate to contact us at contact@booksondemand.ma. We will be happy to help you further.

Skip to content

Skip to content